Invest for your future | Your way

Focus on a long-term investment discipline and create a

savings plan that will help you achieve your vision.

The WealthCoach Playbook

Adulting is expensive. Life happens. Save for the future.

Pay off college debt. Save for a house. Plan a wedding. Start a family. Move to a

new city. Stash some mad money… or build up your rainy day or “FIRE” account.

So, what can you do?

Invest for your future your way.

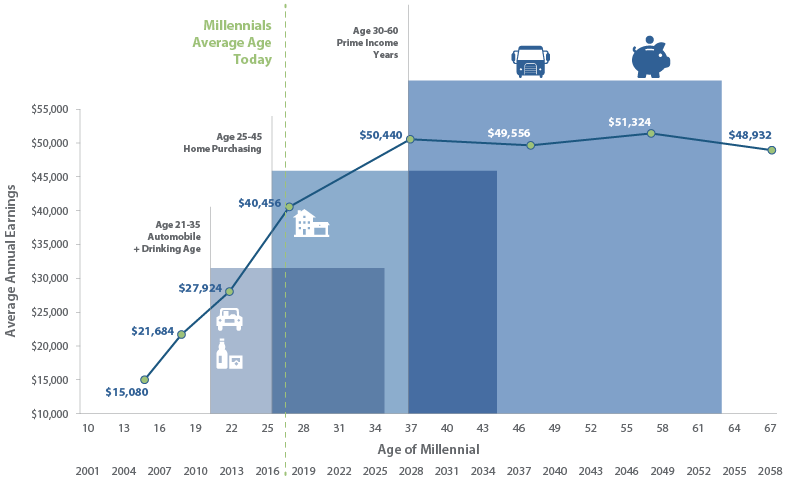

Life Cycle of Millennial Spending and Income

Source: “Real Income” Levels, for those born between 1981 and 2000; Survey of Consumer Finance for 2017

Do the math. Figure it out.

How much do you need to save?

Real-Life

Investment

Solutions

Westwood WealthCoach offers planning tools and

investment strategies to help you grow

your assets and achieve your vision.

Sample Allocations

Fees matter, but performance

matters, too

Fees are important. The right advice, the right approach and strong performance are just as important.

WealthCoach Real-Life Solutions: focused on goals-based investing.

At Westwood WealthCoach, we believe low fees are important, but make no mistake: performance does matter.

Do you want to invest with experienced investment professionals or tech experts, who are training to be investors on your dime?

0.50%

Westwood WealthCoach

offers a low-fee

solution

$25,000 minimum

Existing clients may submit questions through the chat and other communication features of the AskWealthCoach platform for no additional fee. Other users may also submit questions for no fee. However, submitting questions or participating in a few session does not establish an investment advisory agreement or other relationship with Westwood Advisors, LLC.

Thank you for your question.

A WealthCoach advisor will respond to you within the next business day.