Whatever you do, don’t cash out

It can be tempting, but don’t cash out your 401(k) or take a lump-sum distribution. Not only is that money earmarked for your retirement, but the penalties and taxes will probably also cost you dearly. If you are younger than age 55, you will very likely have to pay a 10 percent penalty… and on top of that, you’ll be required to pay taxes on the entire amount of the lump-sum distribution. Of course, it all depends on your personal situation and there are complicated exceptions. If you think you qualify for an exception, we would encourage you to consult with a professional before you move forward.

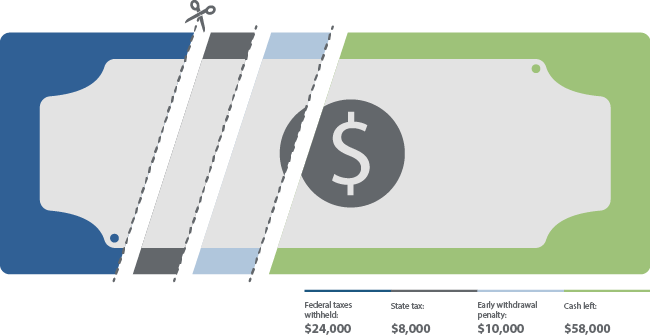

A $100,000 cash out prior to age 59½ could cost $42,000 collectively in federal and

state income taxes1 and the early withdrawal penalty2.

1 Assumes a hypothetical federal income tax of 24 percent and a hypothetical state income tax of 8 percent

2 Assumes a 10 percent early withdrawal penalty

This is an example for illustrative purposes only.

For Educational Purposes Only.

Information about IRA rollovers is intended to be educational only. It is not tailored to the investment needs of any specific investor. This information should not be considered tax or legal advice.

IRA rollovers are subject to complex tax laws and regulations which are subject to change and which can materially affect investment results. Westwood cannot guarantee that this information is accurate, complete or timely. Westwood makes no warranties regarding this information or results obtained by using it. Westwood disclaims any liability arising out of the use of, or any tax position taken in reliance on, this information. Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.