Retirement has changed | Retire healthy

Make a game plan. Doing it your way requires you to focus on a long-term investment discipline and a savings plan.

The WealthCoach Playbook

Your retirement is very different from your grandmother’s.

Pensions are a thing of the past.

You probably can’t count on Social Security.

Funding retirement falls on your shoulders.

So, what can you do?

Make a game plan.

Be Independent. Be Proactive.

Some steps that most people can take that may help you prepare to retire healthy.

Do the math. Figure out what you’ll need.

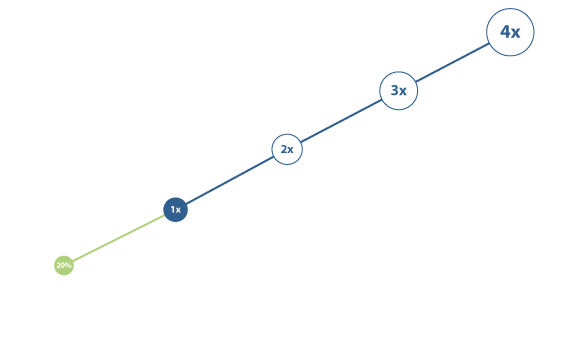

Most people will need $1 million – $4 million. It all depends on the lifestyle you want to live. Knowing what you need is the first step to developing a plan to get you there.

Retirement Savings Rule of Thumb

Plan to live longer

Real-Life

Investment

Solutions

Westwood WealthCoach offers planning tools and

investment strategies to help you grow

your assets and achieve your vision.

Fees matter, but performance

matters, too

Fees are important. The right advice, the right approach and strong performance are just as important.

WealthCoach Real-Life Solutions: focused on goals-based investing.

At Westwood WealthCoach, we believe low fees are important, but make no mistake: performance does matter.

Do you want to invest with experienced investment professionals or tech experts, who are training to be investors on your dime?

0.50%

Westwood WealthCoach

offers a low-fee

solution

$25,000 minimum

Existing clients may submit questions through the chat and other communication features of the AskWealthCoach platform for no additional fee. Other users may also submit questions for no fee. However, submitting questions or participating in a few session does not establish an investment advisory agreement or other relationship with Westwood Advisors, LLC.

Thank you for your question.

A WealthCoach advisor will respond to you within the next business day.