Our Approach

Investing Where It Counts.

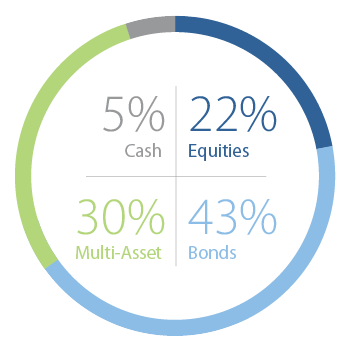

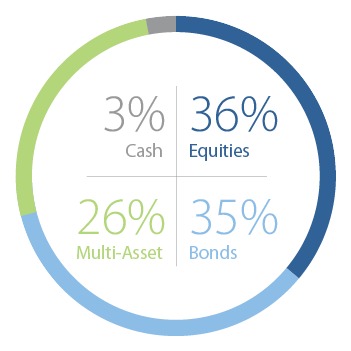

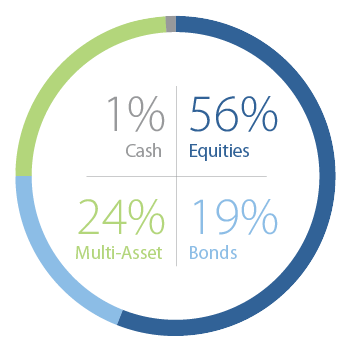

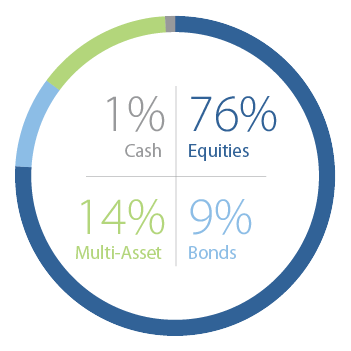

Our hybrid investment models are designed to provide the best options from both our active and index investment allocations. To do this, we select investments based primarily on historical risk and return. Certain asset classes are used to provide a lower cost solution for the allocation, while other asset classes use active managers to provide the opportunity to trade higher quality securities, thereby diminishing the potential impact of a falling market.

The financial team at Westwood WealthCoach researches historical index information versus the universe of managers and determines when to use index solutions and when to use active managers.

Here’s what we

want to achieve.

- Appropriate level of risk

- Low costs

- Outperforming the market long term

- Outperforming in the down markets

Here’s how

we do it.