How much can I roll over if taxes were withheld

from my distribution?

If you have not elected a direct IRA rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over, within 60 days, you must use other funds to make up for the amount withheld.

Example Scenario for Cases When Taxes Were Withheld

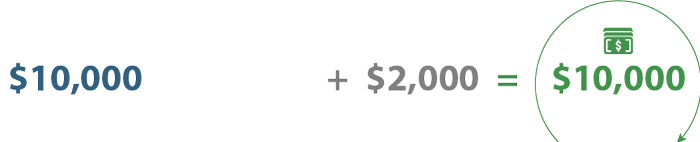

Ashley, age 36, received a $10,000 eligible rollover distribution from her 401(k) plan.

Her employer withheld 20 percent, $2000, from her distribution.

If Ashley later decides to roll over the $8,000, but not the $2,000 withheld, she will report $2,000 as taxable income, $8,000 as a nontaxable rollover and $2,000 as taxes paid. Ashley must also pay the 10 percent additional tax on early distributions on the $2,000 unless she qualifies for an exception.

If Ashley decides to roll over the full $10,000, she must contribute $2,000 from other sources.

Ashley will report $10,000 as a nontaxable rollover and $2,000 as taxes paid.

If you roll over the full amount of any eligible rollover distribution, you receive (the actual amount received plus the 20 percent that was withheld – $10,000 in the example above):

- Your entire distribution would be tax-free, and

- You would avoid the 10 percent additional tax on early distributions.

Source: IRS, March, 2018

For Educational Purposes Only.

Information about IRA rollovers is intended to be educational only. It is not tailored to the investment needs of any specific investor. This information should not be considered tax or legal advice.

IRA rollovers are subject to complex tax laws and regulations which are subject to change and which can materially affect investment results. Westwood cannot guarantee that this information is accurate, complete, or timely. Westwood makes no warranties regarding this information or results obtained by using it. Westwood disclaims any liability arising out of the use of, or any tax position taken in reliance on, this information. Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.